A Smarter Alternative to Accessing Home Equity

No additional monthly payment or new debt

A Home Equity Investment is a new, hassle-free way to access your home equity without taking on new debt or additional monthly payments. With this alternative financial product, you receive a lump sum of cash in exchange for a share of your home’s future value. You can repurchase your investment option at any time within your term with no penalties, and it doesn’t affect your current mortgage.

Why choose an HEI

- No monthly payments

- No income or employment requirements to pre-qualify

- No additional debt

- Streamlined access to cash in just a couple of weeks

- Keep your home and continue living in it

- No effect on your current mortgage rate

Don’t let your home equity sit idle

- Pay off your debts and stop accumulating high interest and stress

- Complete home improvements, major renovations, or repairs

- Create a cash reserve for your family’s childcare and educational needs

- Access cash quickly to handle any unexpected life events or emergencies

The HEI Difference

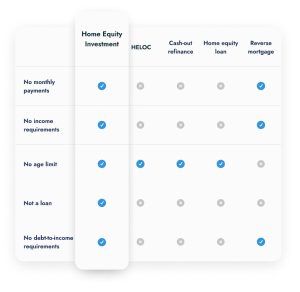

Home Equity Investments (HEIs) are changing the way homeowners access their home equity by providing a hassle-free option without additional monthly payments and no new debt. Unlike traditional financing products, HEIs let you access your hard earned equity without restrictive qualification hurdles and no early repurchase penalties.

How it works

- STEP 1 – Pre-Qualification

Your loan officer will collect some basic information about you and your property. They will evaluate your eligibility for an HEI program and determine an approximate amount of equity that you can access.

- STEP 2 – Complete your Application

This step is surprising simple. You will upload a mortgage statement if applicable, a home insurance declaration page, and a photo ID.

- STEP 3 – Get Approved and Accept your offer

Once your application is complete, your home will be appraised and your loan officer will work with you to coordinate a convenient time to sign your closing documents.

- STEP 4 – Receive your funds

After signing the closing documents, your funds will be wired to your preferred account.

In most cases, the HEI process takes about 10-14 business days. Every situation is different so please consult your loan officer for information on turn times.

FAQ - Frequently Asked Questions

A Home Equity Investment (HEI) provides homeowners with a lump sum of cash today in exchange for a percentage share of the home’s future value. Since a HEI is not a loan, there are no monthly payments or no new debt associated with a HEI.

Nope! There are no income or employment requirements for a HEI.

The initial preapproval is based on just a few items provided by the homeowner.

- Recent mortgage statement

- Home Insurance Declaration Page

- Photo ID

A HEI is not a loan. Therefore there is no monthly payment. A HELOC or standard 2nd mortgage will have a monthly payment and will require the homeowner to provide full income documentation to demonstrate the homeowner’s ability to pay the monthly debt.

Every situation is different. On average, 10-14 business days are needed to process the HEI.

There are no restrictions on how homeowners use their HEI funds.

Your HEI repurchase or pay off is always based on a split percentage that is established when you originate your HEI. If the value of your home goes down, your the amount owed to pay off the HEI will also go down.